These are the nine financial terms that everyone should know. Read on and find out how many of them you already know.

Financial Terms Everyone Should Know

1. Asset

An asset is something that a person, a company, or a country can own, hoping that it will provide a benefit in the future. An asset is something that can:

- Increase its value over time so that you can make a profit by selling it (for example, gold)

- Pay you interest in regular intervals (for example, fixed deposits)

- Reduce your expenses (for example, owning a house so that you don't have to pay rent anymore), or

- Increase sales (for example, machines)

Characteristics of an asset

To figure out if something is an asset, ask yourself if it has the following qualities.

- Ownership - belongs to you

- Economic value - can be sold

- Resource - can generate future-benefits

Types of assets

Going against the general norm of classification of assets, I have classified assets into the following types for better understanding.

Current assets

Current assets are short-term assets that you can convert to cash quickly (within a year). Examples include cash and cash-equivalents (investments that have low risk and low returns) like money market funds, short-term government bonds, etc.

Fixed assets

Fixed assets (also called non-current assets) are long-term assets that you do not wish to convert to cash within a year. These include land, building, furniture, factory, technology, patents, etc. Fixed assets can be further classified into tangible and intangible assets.

Tangible assets

Tangible assets are assets that have a physical presence. These include your house, furniture, factory, etc.

Intangible assets

Intangible assets are assets that don't have a physical presence. These include brand recognition, patents, copyrights, trademarks, customer lists, etc.

Liquid assets

Any asset that can be converted into cash immediately, without losing its value is a liquid asset. Examples include cash, a savings account in your bank, stocks, and even costly jewelry (if it can be sold immediately).

Food for thought:

Is a credit card a liquid asset?

A credit card isn't a liquid asset because even though you can take money out of a credit card, you are borrowing money. So, it doesn't fall under the category of assets because it doesn't have two of the properties of an asset - ownership, and resource. Hence, it is not a liquid asset.

Financial assets

Financial assets are investments whose value comes from a contract. These include stocks, bonds, cash, and cash equivalents, bank deposits, etc. They are further divided into current financial assets and non-current financial assets based on how fast you can turn them into cash.

Capital assets

Capital assets are properties that generate revenue over many years. These include land, furniture, jewelry, etc. for individuals; and factories, machines, equipment, stocks, bonds, etc. for companies.

Why is the understanding of assets essential?

Understanding different types of assets is necessary to categorize all the assets you own and formulate an effective asset management plan. An effective asset management plan does not just guarantee you a stable future, but also the ability to cope with emergencies, should they arise.

For example, if all your assets are fixed assets, then you won't be able to get any cash during emergencies, without borrowing from others.

On the other hand, if all your cash is liquid, your money doesn't generate a better return of investment in the long run.

Hence, diversifying your assets becomes crucial.

2. Liability

A liability is something you owe to someone else as a result of your past actions. It can be a legal obligation, a debt, or a loan. While an asset provides future benefits, a liability takes away future benefits.

Types of liabilities

Current liabilities

Current liabilities are similar to current assets. They are short-term liabilities that need to be paid back within a year. Examples include income tax payable, salaries payable, short-term loans, etc.

Non-current liabilities

Non-current liabilities are long-term liabilities that need to be paid back in more than a year. These include long-term product warranty, pension obligations, mortgages payable, long-term loans, etc.

Contingent liabilities

Contingent liabilities are uncertain liabilities. They may occur as a result of a future event. Examples include lawsuits that a company is facing and product warranties. Depending on whether the event has more than 50% chance of happening, and if one can estimate the resulting amount or not, a contingent liability may or may not occur.

Food for thought:

1. Why is a lawsuit classified as a contingent liability?

If someone sues the company for a million dollars, no liability will arise until the company loses the case. Until the company loses the trial, the company cannot be sure about the possibility of the payment and the amount of money it needs to pay. Hence, a lawsuit is a contingent liability.

2. Whenever a company purchases something from a supplier promising to pay the money at a later date, it results in accounts payable. Most suppliers demand that the company pays this amount within 90 days. Under what type of liability do accounts payable fall?

Current liability, because the company has to pay it within a year.

3. Equity

Equity is the degree of ownership in an asset after subtracting all the liabilities associated with that asset. Therefore, you can calculate equity using the simple formula:

Equity = Market value of the asset - Liabilities associated with that asset

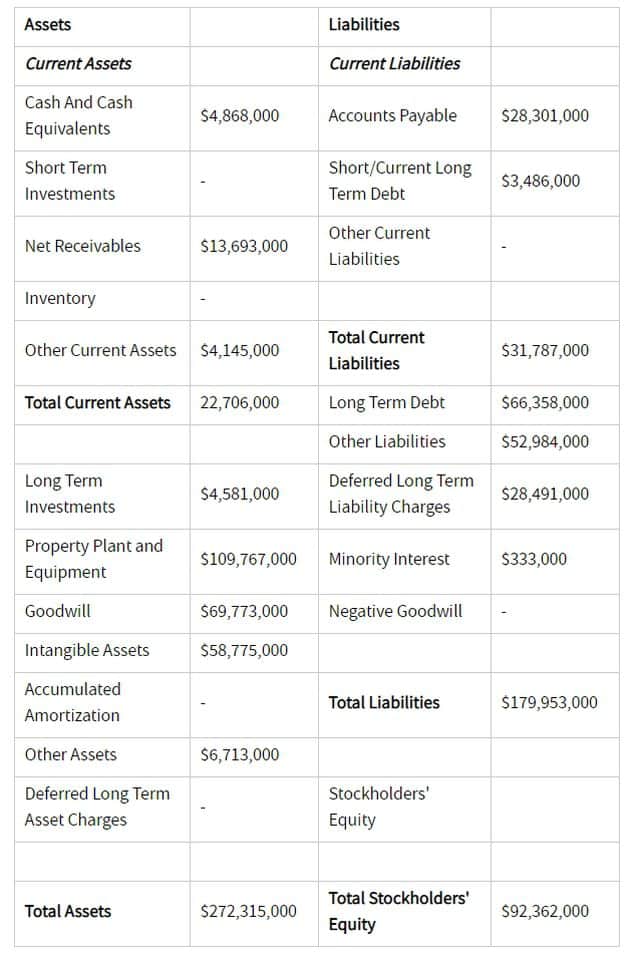

The picture below explains how assets, liabilities and equity are calculated.

Calculation of Asset, Liability, and Equity - Picture credits

When the asset in question is a company, equity becomes shareholders' equity. The formula is the same.

Shareholders' equity tells us how much of the owners' investment in the company remains after all the liabilities have been paid off.

What is the significance of equity?

Equity provides you the following details:

1. Find out if you are financially stable - If you have negative equity, it means your expenditure is more than your income. So, it is high time you start reducing your spending.

2. Find out if you should invest in a company - One look at the equity of a company will tell you if you can get a profit by investing in its shares. If the company has had negative equity consecutively for several years, it might be an indication that it is going towards bankruptcy. Hence, you should avoid investing in the company.

3. Find the net worth of a product/property - This is useful if you have a house and want to sell it. If your house's market value is $200,000, and you have to pay $100,000 for its housing loan, the house is worth an equity of $100,000. This is the amount that will remain after selling your home and clearing the housing loan.

4. Net worth

Net worth is the measure of the wealth of a person, a company, or any other entity. It is the difference between total assets and total liabilities.

5. Capital gain

An increase in the market value of a capital asset in comparison to its cost price is called capital gain.

Types of capital gain

Unrealized capital gain

When the market value of the capital asset increases, but you haven't sold the asset yet, it is called an unrealized capital gain.

Realized capital gain

When the market value of the capital asset increases and you sell the asset, it leads to a realized capital gain.

Why is the study of capital gains necessary?

Understanding taxes - Understanding capital gains and its different types are essential to figuring out how much tax a company should pay. For example, realized capital gains are taxable in most countries, but unrealized capital gains are not taxable.

When a company wants to raise money for its business, it can either borrow money from a bank or sell its shares. Borrowing money is a liability since the company has to pay the money back eventually. So, most companies decide to sell their shares.

A share is the smallest unit of ownership of a company (or a mutual fund). If you buy a share of a company, you become its shareholder. As a shareholder, you get two advantages:

- Whenever the company makes excess earnings, it can pay you a part of this profit (also called Dividends).

- When the company's shares rise in the future, you can sell them and make a profit.

7. Stock

A stock is a collection of shares of one or more companies. Stocks can be bought in fractions, whereas shares can only be purchased as a whole.

8. Stock options

Companies sometimes offer their employees stock options. Stock options enable employees to buy a fixed number of shares at a fixed price for a fixed amount of time. The number of shares that an employee can buy, the cost, and the duration are fixed by the company.

An example to help you understand

For example, company A can provide stock options for its employees to buy ten shares at $100 a share for two months, whereas each of its shares costs $200 in the stock market. Now, as an employee, you have two options:

- Buy some or all of the ten shares for $100 within two months

- Not buy any shares

If you don't buy any share, you don't lose anything, but at the same time, you don't gain anything. Simply put, you are passing up on the incentive provided by the company.

However, if you choose to buy some or all the shares, then, again you have two options:

- Sell the share after the duration provided by the company and make $100 profit on each of the shares instantly (Since you paid only $100 for each of the shares that cost $200).

- Keep the shares, hoping that their value will go up and sell them at a later date.

Why do companies provide stock options?

Companies provide stock options because they want to encourage their skilled employees to stay by providing not just any incentive, but an incentive that gives them a sense of ownership in the company.

9. Depreciation

Depreciation is the reduction in value of an asset over time. This occurs mostly due to wear and tear.

For example, your car might have cost $50,000 when you purchased it. But after two years of usage, its market value might drop to $43,000 because the car is not new anymore. Several parts of the car might have undergone wear and tear and might not be as effective as new parts.

We hope that this blog post helped you learn about the nine financial terms everyone should know. If you liked this blog post, you may like the following blog posts too.