Regardless of who you are and how old you are, investing today can make your tomorrow safer. While investing can be fruitful, choosing the right investment strategy is important too.

Depending on the investment strategy, a prince can become a pauper, and a pauper can become a prince. So, make sure you choose your investment strategy wisely.

"Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1" – Warren Buffett (Source)

This blog post will help you understand the different ways in which you can invest your hard-earned money. Depending on your country of residence, one or more of these investment options may not be available to you. So, try to find out which of these options are available in your country.

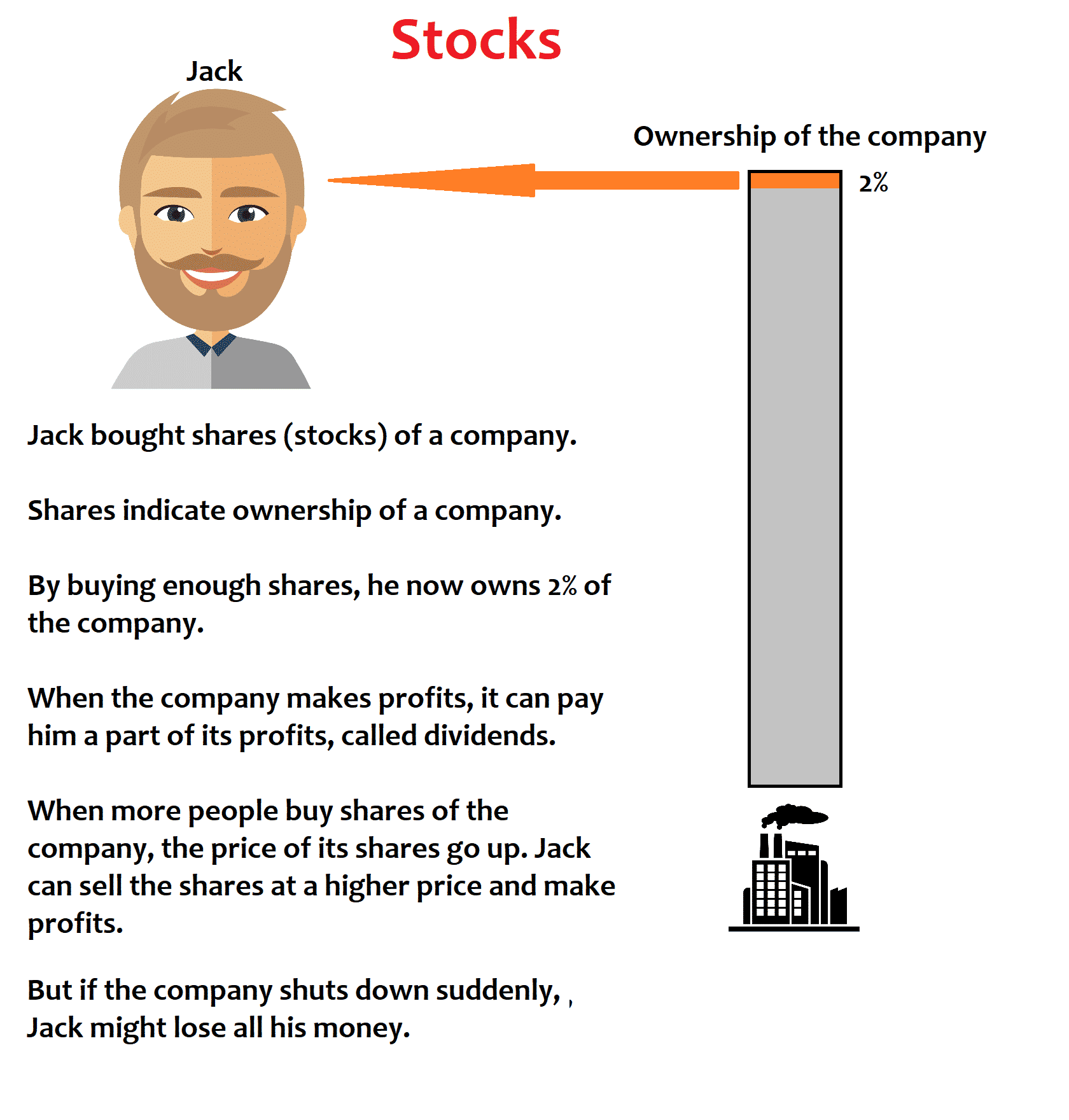

1. Stocks

A stock is a small unit of ownership of a company.

When you purchase a stock of a company, you buy a small piece of the company. This gives you a small fraction of ownership of that company.

By purchasing a stock of the company, you can gain two advantages:

- When the company makes profits, the value of your stock goes up. You can then sell it to make a profit.

- When the company makes excess earnings, it can pay you a part of its profits. These are called dividends.

Investing in stocks can be extremely risky. This is especially true when starting out.

How are stocks traded?

Stocks can be traded in an exchange or over the counter. Let's see how they differ from each other.

Trading time

An exchange is a physical location. So, trading in an exchange happens only five days a week when the exchange is open.

In OTC trading, assets are purchased and sold between two parties (dealers and institutions), without the supervision of an exchange. Unlike in an exchange, trading is not done at a physical location. Trading is usually done over the phone, emails, or computer networks. So, OTC trading is done 24 hours a day, five days a week.

Transparency

Trading over an exchange is more transparent and subject to more regulations. Therefore the prices of the commodities you buy or sell in an exchange are openly known to everyone.

Trading over the counter is not so transparent. When commodities are bought or sold over the counter, the price of the transaction may not be known until the transaction is completed.

Assets

Stocks of big companies are traded in an exchange. Stocks of small companies and other assets, which cannot afford the fees and regulations of the exchange are traded Over The Counter.

Price

In exchange, the prices are determined by demand and supply of commodities. However, in OTC trading, prices are set by the dealers.

What should you know before getting into the stock market?

How much should you invest?

Investing in the stock market is a risky ordeal. There is a chance that you might lose all the money you invest. So, invest only the amount of money that you can afford to lose. As you gain experience, you can invest more.

How long should you keep a stock?

It might be tempting to invest in the stock market to become rich quickly. However, in the stock market, there are very few overnight millionaires.

Most successful people in the stock market are there for the long run. They investigate the company properly before investing in it. Once they invest in it, they hold the stock for months or years, sometimes even for decades, before selling it. You can also opt for a similar strategy.

How to choose the right stock to invest in?

Measuring volatility - The volatility of a stock indicates how much it fluctuates with the market. For example, let's calculate the volatility of Facebook's stock. Go to Yahoo Finance. Type Facebook in the search bar, and click on Summary. The variable called Beta indicates the volatility of Facebook's stock.

A value of 1 is the average. Any value below 1 shows that the stock is stable. The stock's price doesn't fall ridiculously if the market comes crashing down. On the other hand, its price doesn't soar to the sky if the market goes roaring up. Any value more than 1 indicates that the stock is volatile, and varies heavily with the market.

If you want to minimize your risks, you should go for a company whose Beta value is less than 1.

Measuring profitability

EPS (Earnings per Share) is a company's profit divided by its total number of shares. This is the amount of profit you would get if you own one share of that company.

EPS is a measure of how profitable a company is. If a company is profitable, its EPS should grow steadily every year. In addition to that, its EPS should be higher than its competitors in the same category. So, to find a profitable company, compare its EPS to its past and with its competitors.

You can find the historical data (Revenue, Profit, EPS, etc.) from Yahoo Finance by clicking on the 'Financials' tab and then on the 'Income statement.' Data from the last four years are displayed free of cost.

How expensive is a stock?

You can use PE Ratio (Price to Earnings Ratio) to find out how costly a company's stock is. It tells you how much you should pay to get a profit of $1.

The PE Ratio is the company's stock price divided by its EPS. A higher PE Ratio could indicate that the company's stock is overpriced, but its profits aren't that huge.

A smaller PE Ratio could suggest that the company's profits are higher, even though its stock is cheap. However, it could also mean that very few people invest in the company because they are wary of its performance. This could be an indication that the company's profits are going to take a nosedive.

So, while a low PE Ratio means that the stock is cheap, it doesn't necessarily mean you have to buy it. Compare the PE Ratio with other companies in the same category and also with the category average.

Before you buy a stock, find out why it is cheap. Gather more information about the company and the current market. Read about the companies' future plans and products, the skills of the CEO, etc.

Estimating ROI

The inverse of PE Ratio gives you the ROI of a stock. You can use it to compare the ROI of the stock with other investment models like bonds, etc.

When should you buy a stock?

Identifying the trend - Before investing in a company's stock, find out if it is following a bullish or bearish pattern. A bullish pattern implies that the stock's prices have been rising steadily. It is an indicator that you can profit by investing in that stock. A bearish pattern indicates the opposite. This information is listed in Yahoo Finance, in the Summary tab, under the company's chart.

How can you buy a stock?

Through the most part of the Twentieth century, people had to go to the stock market and wait for hours to buy a stock.

Nowadays, you can open an account with an online stockbroker and start trading immediately. So, choosing the right online stockbroker is very important. Figuring out the following details about a stockbroker can help you make an informed decision.

Opening an account

Does the stockbroker charge you money for opening an account? If the account is free of cost, do they offer access to a trading platform?

Minimum deposit

How much money should you deposit to open an account?

Maintenance fees

Is there a monthly or annual fee for maintaining your account?

Commissions

How high are the commissions? Do you have to pay a commission every time you buy or sell a stock? If so, how does it change depending on how often you trade? Does it increase when you trade often, or does it increase when you trade rarely?

Other investment options

Does the stockbroker offer additional investment options, like mutual funds, etc.?

Tools to learn

Does the stockbroker offer enough educational tools to help you learn? Can you open a demo account and learn to trade before actually jumping into the stock market? Are there professionals who can guide you when you are in need?

Security

How is your account protected against fraud? How is your money insured if the company offering stock brokerage goes broke?

These are the basics you need to know before buying stocks. If you want to invest in the stock market, consider reading more about it.

Scores

Savings

ROI

Ease of Accessibility

Risk

NA

Very High ( > Term deposit account)

High

Very High

Savings - NA

ROI - Very High ( > Term deposit account)

Ease of Accessibility - High

Risk - Very High

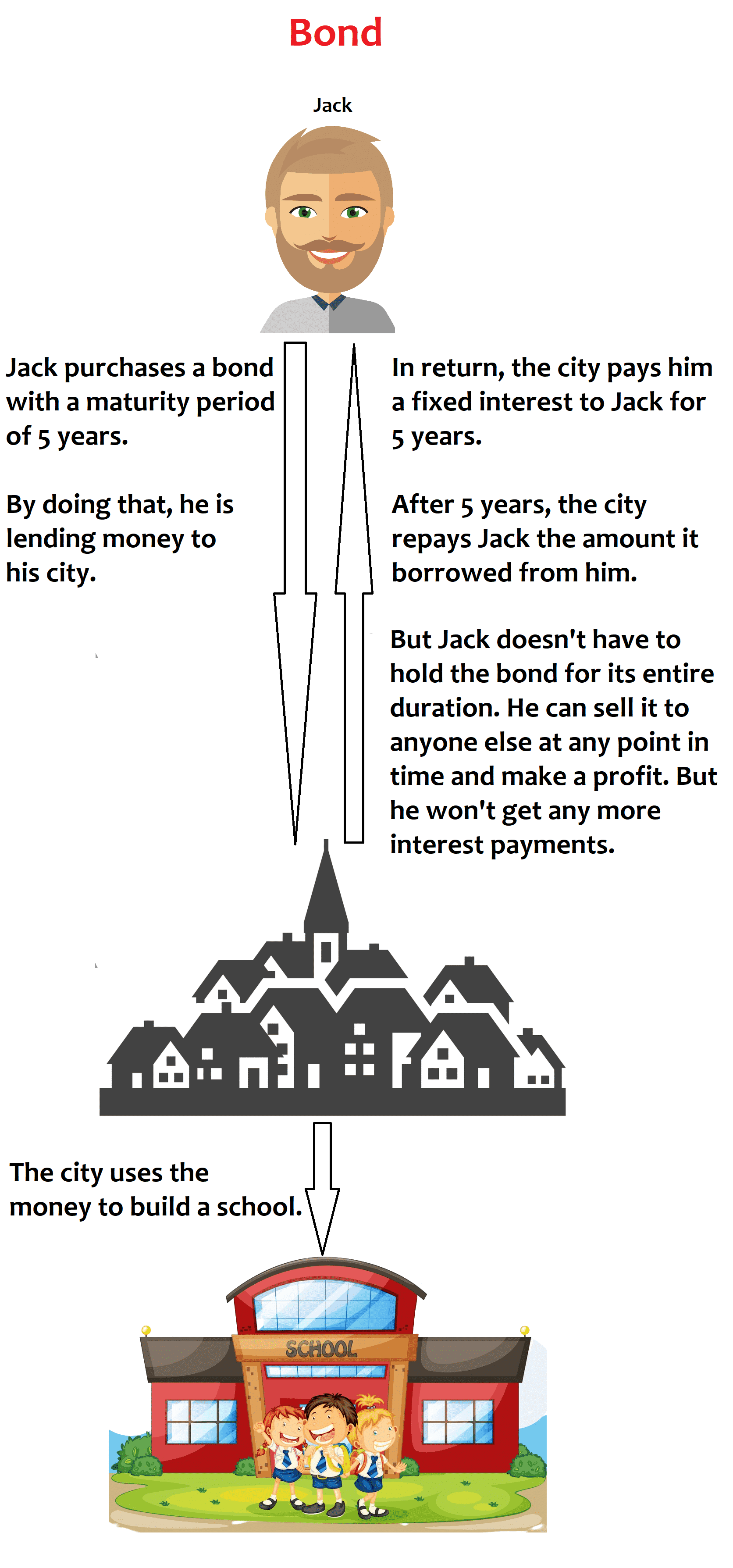

2. Bonds

Let's understand what Bonds are, with the help of an example.

Let's assume that you are in sudden need of money. If the amount you need is $100, you can ask a friend to lend it to you. However, if you need $2,000, a single friend may not be able to give it to you. So, in this case, you can ask 20 friends to lend you $100 each.

After a year, when you have enough money, you decide to return the money to your friends. But you don't return them just the $100 you borrowed. Instead, you add $5 to the amount and give each of them $105 as a way of thanking them for helping you when you needed them the most.

Similarly, governments need money to build roads, construct schools, and other public welfare projects. Likewise, large companies need enormous funds to expand their businesses.

Banks may not be able to provide such huge amounts of money to these organizations. Or, they might charge high interests.

On such occasions, these organizations borrow fixed denominations of money (say $1000) from multiple people (investors). To each of these investors, they pay a fixed interest every year and return the borrowed amount after a fixed amount of time.

To do this, they issue bonds and sell them. When you purchase a bond, the company issuing the bond promises to pay you interests at regular intervals until the maturity period expires. Once the maturity period expires, it repays you the borrowed amount. The bond agreement lists the terms of borrowing, including the amount borrowed, the promised interest rate, and the period, after which the entire money should be returned.

Bonds can be purchased or sold, and are traded publicly, like stocks.

So, you can make money from bonds in one of the two ways:

- Hold the bond until the maturity period expires. In this case, you receive regular interest payments until the maturity period expires. Once the maturity period expires, you get the original principal that was borrowed from you.

- If the price of the bond increases, sell it, and make a profit.

Even though bonds are traded like stocks, they are not as risky as stocks. This is because stocks are small pieces of the company. So, their price depends directly on the performance of the company.

Bonds, on the other hand, are loans lent by you to the company. Their price doesn't directly depend on the performance of the company.

How do bonds work?

Bonds are a bit complex to understand. So, we will explain this with the help of an example.

Let's assume that a company XYZ issues bonds to generate funds to build a new branch in Australia. Each bond is worth $1000. This is called the Face Value of the Bond.

XYZ promises to repay the Face value in 20 years. This is the maturity period or the lifetime of the bond.

XYZ promises to pay yearly interests at a rate of 5% of the face value. This amounts to $50 p.a. This is called Coupon, and the rate is called the Coupon Rate. This is fixed for the lifetime of the bond. The Coupon rate offered by companies is generally the same or higher than the market interest rates when issuing the bond.

Case 1:

In the next year, let's assume that the market rates drop to 3%. Now, new bonds cost $1000 but pay only $30 (3% of $1000) yearly as Coupon. Even the company that issued the bond to you last year is issuing new bonds, but only at a reduced rate (3%). So, the bond you purchased last year becomes attractive to other investors because it offers $50 yearly payments.

Now, people are willing to pay more to buy that bond from you. Hence, the price of your bond increases in the bond market. It can only increase up to a value of $1667, at which point, a 3% interest rate would pay $50 annually. If it increases beyond this value, no one will purchase it. Now, your bond is said to be trading at a premium because it is costlier than the Face Value.

Now, you have two choices:

- If you are a bond investor, you can keep the bond. In this case, the Coupon rate doesn't change for you. You will receive the same Coupon of $50/ year (5% of $1000) for another nineteen years. The Coupon payments you get during this time will add up to $50 x 19 = $950.

- If you are a bond trader, you can immediately sell the bond and make a profit of $1667 - $1000 = $667.

Case 2:

In the next year, let's assume that the market rates increase to 7%. Now, new bonds cost $1000 but pay $70 (7% of $1000) yearly as Coupon. Even the company that issued the bond to you last year is issuing new bonds, but only at an increased rate (7%). So, the bond you purchased last year becomes unattractive to other investors because it brings only $50 as yearly payments.

Now, people are not willing to buy that bond from you. So, if you want to sell it, you can only sell it at a lower price. Hence, the price of your bond decreases in the bond market. However, it can only decrease up to a value of $714, at which point, a 7% interest rate would pay $50 annually. If it decreases beyond this value, everyone will want to purchase it, but you will face higher losses. Now, your bond is said to be trading at a discount because it is cheaper than the Face Value.

Now, you have two choices:

- If you are a bond investor, you can keep the bond. In this case, the Coupon rate doesn't change for you. You will receive the same Coupon of $50/ year (5% of $1000) for another nineteen years. The Coupon payments you get during this time will add up to $50 x 19 = $950.

- If you are a bond trader, you can immediately sell the bond and suffer a loss of $1000 - $714 = $286. You can then add another $286 to it and buy a new bond for $1000 at a 7% Coupon rate. Then the sum of Coupon payments you get over 19 years would add up to $70 x 19 = $1330.

Case 3:

The market rates remain the same next year as well. Then, the bond is said to be trading at par. You can either keep the bond or sell it, even though selling it wouldn't give you an advantage.

What should you look for in a bond?

Default risk

This is the most important factor. Before purchasing a company's bond, find out if the company can repay the bond. Sometimes, companies might list a physical asset as a mortgage for the loan. In some countries, bond ratings, issued by trusted institutions, can gauge a bond's credibility.

If neither a mortgage nor a bond rating is available, find out if the company's income is more than its debts. If not, stay away from the company's bond.

While highly credible bonds are safer, less credible bonds pay higher interests. Thus, investors willing to take higher risks can get higher ROI by investing in these bonds.

Interest rate risk

If you plan to hold a bond till maturity date, you don't have to worry about future interest rates. But if you purchase a bond with the sole aim of selling it at a higher price, there is a risk that the interest rates might go up in the future due to inflation. In turn, the price of the bond will go down, and you might be stuck with a bond that you cannot sell.

Alternatively, if the interest rates go down in the future, the price of your bond will go up. In such a case, you can profit by selling your bond.

Liquidity Risk

Based on the type of bond you purchased, selling it in a bond market can become difficult. Consequently, you might end up holding it till the maturity date. So, either buy a bond that you are willing to hold till maturity or a bond that you can sell without fail.

Call risk

There is a type of bond called a Callable bond. A Callable bond gives the issuer the option of paying off the debt before the maturity date while offering a higher interest rate. When the interests go down, the company can buy the Callable Bond back from you at face value. It can then issue it at a lower interest rate.

So, by purchasing a Callable bond, you can benefit from the higher interest rates. However, if the prices go up in the future, you will not be able to profit from it.

How much should you pay for a bond?

Once you find a Bond with a good Coupon rate, you might want to buy it as soon as possible. But, in your haste, don't end up paying too much for an actually cheaper bond. Do due research to find out what price the bond was sold at recently, and what interest rate was offered.

Maturity period

When it comes to bonds, the maturity period is an important factor. Interest rates in the bond market generally don't vary rapidly as in a stock market. In short-term bonds, which mature within four years, the risk of the interest rates going up, and the price of the bond declining is low.

However, in bonds with long maturity periods, this risk is higher. Hence, to compensate for this risk, bonds with longer maturity periods (10+ years) offer higher coupon rates.

So, depending on your strategy (investing or trading), you have to choose the maturity period wisely.

How to buy a bond?

There are several ways to buy a bond.

1. Buying directly from the government.

2. Buying through a brokerage firm - Brokerage firms have inventories of bonds that they purchased from an open market.

If you buy a bond in their inventory, it might appear as if you are not paying any commissions. However, they can mark up the price, i.e., sell the bond to you at a price higher than the price at which they purchased it. Brokerage firms normally don't disclose the amount by which they mark up the price. However, you can calculate it out yourself by using Yahoo Finance to find the price at which the bond was sold recently.

Similar to a markup price, the brokerage firm may charge a markdown price when you sell a bond to the firm.

If you want to buy a bond that is not in their inventory, you have to pay a commission to the firm. Commissions are generally charged as a percentage of the bond's price. You can ask the firm to find out how much this commission is.

These are some of the information you have to figure out before choosing a brokerage firm.

Types of Bonds

There are three major types of bonds. Depending on the risk you want to take, the amount you want to invest, and the amount of resulting taxes, you can choose one of these.

Corporate bonds - Corporate bonds are bonds issued by private companies. They are riskier but offer better interest rates. However, the interests are taxable.

Government bonds - These are bonds issued by the government. They offer lower interest rates. But, the interest could be exempt from state and federal taxes.

Municipal bonds - Municipal bonds are issued by a municipality, state, or country. Even though the interest rates are lower than other types of bonds, the interest is tax-free.

Scores (Bond investor)

Savings

ROI

Ease of Accessibility

Risk

High

Medium ( > Term deposit account, but < Stocks)

Very low

Medium (< Stocks)

Savings - High

ROI - Medium ( > Term deposit account, but < Stocks)

Ease of Accessibility - Very low

Risk - Medium (< Stocks)

Scores (Bond trader)

Savings

ROI

Ease of Accessibility

Risk

Low

High ( > Term deposit account, but <= Stocks)

Low

Medium (< Stocks)

Savings - Low

ROI - High ( > Term deposit account, but <= Stocks)

Ease of Accessibility - Low

Risk - Medium (< Stocks)

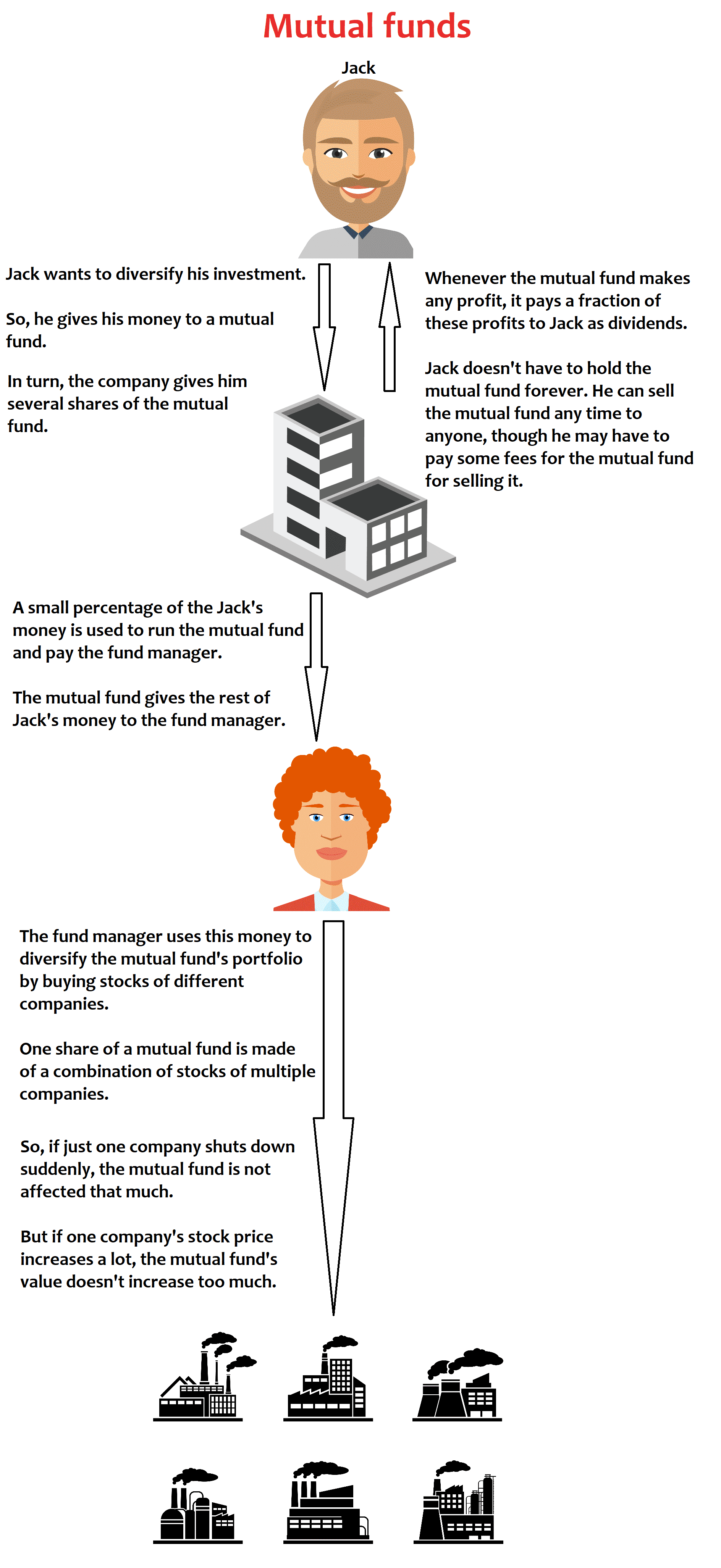

3. Mutual funds

To understand what Mutual funds are, read the following example.

Let's say you have $3000 to invest. Several cases are possible, depending on your investing strategy.

Case 1: The Risk-taker and stocks

Let's assume that you like to take risks that pay off well. So, you invest $3000 in a company's stock. Based on its recent history, you expect it to perform well.

Positive scenario

Everything goes as per plan. In two years, your stock grows by 30% to $3900. You sell it and make a profit of $900.

Negative scenario

Nothing goes according to plan. In two years, your stock has come down by 30% to $2100. Market experts speculate that the company might shut down soon. So, you sell your stock and suffer losses amounting to $900.

Case 2: The Risk-taker and Bonds

Let's assume that you like to take risks that pay off well. So, you buy three Bonds from a company totaling $3000. The company's credit rating is poor. So, it promises a yearly interest rate of 30% and promises to pay back your $3000 in 2 years.

Positive scenario

Everything goes as per plan. In two years, you have gotten your $3000 back. In addition to that, you have made a profit of $900 + $900 = $1800 (assuming that you don't reinvest the interest).

Negative scenario

Nothing goes according to plan. Within a year, the company has defaulted. After the company sells all its assets, you get back only $900. So, you have suffered a loss of $2100 by investing in the company's Bonds.

Case 3: The Safe-player and Bonds

You are a person who likes to play it safe. So, you take the $3000 and invest it in secure Bonds for five years. But since the company has high credibility, you get only an interest rate of 2% p.a.

Positive scenario

In two years, you sell the Bonds when they are trading at $3090. So, now, you have made a profit of $3090 - $3000 = $90 + 2 x $60 (Interest payments every year) = $210. In addition to that, you have gotten your $3000 back.

Negative scenario

The Bonds you have purchased don't do well in the Bond market. If you sell them, you will incur losses. So, at the end of two years, you have made a profit of 2 x $60 = $120. But, your initial investment of $3000 is still stuck in those Bonds.

You wait another three years till they expire. By the end of five years, you have made a profit of 5x$60 = $300 and got your initial investment of $3000 back. But in these five years, you have missed many opportunities for investing this $3000 to make better profits.

Case 4: The one who diversifies

You are a person who doesn't keep all your eggs in a basket. So, you invest $1000 in the stock (Case 1), $1000 in the low-profile bond, and $1000 in the high-profile bond (Case 3). Since there are three investments in your portfolio, the chances of all of them generating profit or loss are meager. But for the case of argument, let's consider the best- and worst-case scenarios.

Best-case scenario:

At the end of two years, you get profits from all of your investments.

Stock : 30% x $1000 = $300

Bond 1: 2 x (30% x $1000) = $600

Bond 2: 2 x (2% x $1000) + ($1030 - $1000) = $70

So, you get a total profit of $970 from all your investments at the end of two years. You also get your initial investment of $3000 back.

Worst-case scenario:

At the end of two years, you suffer losses from all your investments.

Stock : -30% x $1000 = -$300

Bond 1: -$700 (You get only $300 back from your original investment of $1000)

Bond 2: 2 x (2% x $1000) = $40

So, you suffer a loss of $960 (-$300 -$700 + $40) from all your investments at the end of two years. The initial amount of $1000 you invested in bond 2 is still safe. Of the remaining $2000 you invested, you have $1040 remaining to invest now.

As you can see, by diversifying, you can reduce your losses (Please note that the worst-case scenario mentioned above may never happen). At the same time, you won't get the best gains out of it as well. Diversification makes sure that your investment remains safe while giving you reasonable returns.

This is exactly what a mutual fund does. It diversifies your investment portfolio. A mutual fund is a company that invests its money in different stocks, bonds, and other securities. By buying a mutual fund, you are purchasing a share (stock) of that company. The value of your mutual fund depends on the performance of the individual investments in the investment portfolio of that company.

By investing in a mutual fund, you can minimize your losses and keep your investments safe, while receiving better returns than a Term deposit account. Moreover, a mutual fund offers other advantages as well.

- Less stressful - Even though diversification is a wise thing to do, choosing the individual investments to add to your profile can be stressful. If you are new to investing, it can be far too much for you to handle. Mutual funds take this stress away by choosing individual investments. Your job is to find a mutual fund that suits your strategy.

- Affordable - To truly diversify your portfolio, you need a huge amount of money (>$10,000). But you can buy a mutual fund for a fraction of the cost (<$500).

- Managing your funds - If you want to hire a fund manager who tracks your investments daily, it can cost you a lot. A lot of professional fund managers only manage the accounts of investors who have at least $100,000 to invest. Professional fund managers buy and sell securities in a mutual fund. By investing in a mutual fund, your money (as well as others' money) will be invested in securities to meet your goals.

- Easy withdrawal - Mutual funds deal with the investments of multiple people. So, they always have cash readily available, should any investor want to sell his/her mutual fund. So, you can be sure that you can get your money when needed.

- Dividend reinvestment - Whenever a stock in a mutual fund pays dividends or a bond in a Mutual fund pays interest, mutual fund collects these payments. It then distributes these payments as mutual fund dividends to you and other investors. You can ask the company to automatically reinvest these dividends into the same or another mutual fund.

Types of Mutual funds

The major types of mutual funds are

Equity funds

Also known as Stock funds, this type of mutual fund invests in stocks.

Based on the market cap of the companies they invest in, equity funds can be categorized into large-, medium- and small-cap funds. Market cap (=share price x number of shares) is the overall market value of a company.

Based on the investment strategy, equity funds can be categorized into value-, blend- and growth-funds. Value funds invest in undervalued stocks. These stocks have prices that are low at present but have high chances of increasing in the future. Growth funds, on the other hand, invest in high-performing, expensive stocks. These are the stocks that have shown nice growth in the past and can continue growing in the future. Blend funds are mutual funds that lie in between value and growth funds.

Industry (sector) funds, another category of equity funds, enable you to invest in the stocks of companies in a particular industry. For example, if you think companies like KFC, Mc. Donald's and Subway will grow in the future, you can invest in the fast-food industry fund.

The risk in an equity fund is that it depends on the rise in the price of the underlying stocks.

Fixed-income funds

This type of mutual fund focuses on purchasing government and corporate debt. It is relatively safer than equity funds.

Also known as Bond funds, fixed-income funds invest primarily in bonds. The underlying bonds pay a percentage of the investment as interest every month. These interests, when added up, become the source of income for the fixed-income fund. This income is then passed on to the investors at regular intervals (usually every month).

Bond funds can also differ based on the strategy of investing. Some bond funds focus on secure government debts. Such a bond fund can keep your money safe but only offers low returns every month. In contrast, some bond funds focus on buying undervalued junk bonds to sell them at a profit. Such a bond fund can promise you high returns, but you may not get your money back.

Money-market funds

These are mutual funds that invest in short-term, safe debt (mostly government debt). The interest offered by a money-market fund is generally only slightly higher than a savings account. However, you can be sure that your money is safe and withdraw money whenever you need it. People nearing retirement are generally advised to invest their money here.

Balanced funds

These are mutual funds that invest in different asset classes (stocks, bonds, money market instruments, etc.) at the same time. There are two major types of balanced funds.

Specific allocation funds - You decide the percentage of your investment you want to allocate to each asset class. For example, you can allocate 40% of your money to stocks, 50% to bonds, and 10% to money market instruments.

Dynamic allocation funds - You give the fund manager the full freedom to allocate your money to different asset classes. Depending on your investment goals and the market's performance, he/she can reallocate your money as he/she sees fit.

Different risks to consider while choosing a mutual fund

Risk of falling prices

Mutual funds offer an excellent way to diversify your investment portfolio. Yet, the value of a mutual fund depends on the underlying assets. As a result, there is the risk that the Net Asset Value of a mutual fund can be lower when you want to sell it. Net Asset of a mutual fund is the difference between its assets (e.g., stocks it purchased) and its liabilities (e.g., salaries of its staff). When you divide the Net Asset by the total number of shares of the mutual fund held by all its investors, you get Net Asset Value.

For example, let's consider a mutual fund X that has stocks from companies A, B, and C. Let's assume that the stocks of A are priced at $10 each, B at $20 each, C at $30 each. Let's say the mutual fund owns 3, 4, and 2 shares of A, B, and C, respectively. So, the value of all the stocks the mutual fund owns is (3 x 10) + (4 x 20) + (2 x 30) = 170. Let's say that the mutual fund made a profit of $5 on that day. It also had to pay staff salaries of $2, other operating costs add up to $0.25, and miscellaneous expenses of $0.5. Let's assume that the number of shares of the mutual fund in the market is 10. Then, the NAV at the end of that day can be calculated, as shown below:

NAV = Net Asset / Total number of outstanding shares

NAV = [Assets - Liabilities] / Total number of outstanding shares

NAV = [(170 + 5) - (2 + 0.25 +0.5)] / 10

NAV = $17.23

Trading price - Thus, a mutual fund has a Net Asset Value (NAV). However, its price in the market may not always be equal to its NAV.

Several factors, including supply and demand, the popularity of its fund manager, etc. influence its trading price. If the mutual fund is in high demand, but the supply is lower, its price might be greater than its NAV. The same is true when the fund manager is known to make the right stock purchasing decisions. The reverse is also true.

Risk of dilution

A mutual fund can post good profits when starting out. Hence, it becomes popular and receives more funds. However, as the investments increase, it becomes difficult for the fund manager to find new profitable investments.

Too much diversification also means high profits from a few investments would make little positive difference. Hence, as the mutual fund company grows too big, the returns might actually start to reduce.

Risk of losing out

Stocks can be bought or sold any time the market is open. However, mutual funds can be bought or sold only at the end of the day. Therefore, if the price of a mutual fund rises during the day, but falls at the end of the trading day, you end up missing out on the opportunity to profit from the rise during the day.

Risk of too much liquid cash

Many people invest and withdraw money from a mutual fund every day. So, typically, a mutual fund has a lot of liquid cash available at any moment. It means that you can withdraw your money at any time. However, this also means that this money is not invested in the market. In turn, this can affect the returns offered by a mutual fund.

Risk of too little diversification

A mutual fund that focuses mostly on high-risk or industry-specific stocks is still prone to high risk.

Risk of too much fees

A mutual fund is managed by a professional fund manager. Regardless of whether the mutual fund makes profits or losses, the fund manager gets paid. Hence, in times when the returns are meager or negative, you could actually end up losing money.

Moreover, mutual funds do a lot of purchasing and selling of assets (e.g., stocks). This leads to increased brokerage commissions, also known as trading costs. This cost is also typically borne by the investors.

Entry loads (money for joining the mutual fund) and Exit loads (selling your mutual funds before the specified time) also add to the costs.

What should you research before investing in a mutual fund?

Since investing in a mutual fund can quickly turn out to be a costly endeavor, research about the following beforehand.

The Fund manager

The returns of a mutual fund depend mostly on the fund manager. If he is too greedy and invests in high-risk assets, you may end up losing your money. So, before you invest your money, find out how his/her career has been. Find out if he/she has expertise in finance and how his/her track record in the industry has been.

Entry and Exit loads

Enquire about the entry and exit loads before you invest in a mutual fund.

Taxes

The returns of some of the mutual funds could be taxed (e.g., bond funds with monthly returns). So, inquire beforehand about the taxability of the returns.

Scores

Savings

ROI

Ease of Accessibility

Risk

Low

Medium to high ( > Term deposit account,

but < Stocks)

High

Low (< Bonds)

Savings - Low

ROI - Medium to high ( > Term deposit account,

but < Stocks)

Ease of Accessibility - High

Risk - Low (< Bonds)

4. Index funds

To understand what Index funds are and how they work, we should first know what a market index is.

What is a Market Index?

A market index combines the values of several assets of a particular type (e.g., the stocks of several companies) to calculate an aggregate value. It is a measure of the performance of an entire sector or the whole market (e.g., the stock market of a country).

The market's performance in the future can be predicted by observing the change of market index over time. Investors generally compare the evolution of a stock's price over time with that of the market index to figure out if the stock can be profitable.

For example, the S&P 500 is a market index in the USA. It is the aggregate value of the stock prices of the 500 largest companies in the USA. In the S&P 500, bigger companies have a greater impact on the index value.

For example, let's assume that there are three companies A, B & C. A has 3 shares, which cost $100 each; B has 5 shares, which cost $150 each; C has 8 shares, which cost $200 each. The total market value of the index tracking these stocks will be (3 x 100) + (5 x 150) + (8 x 200) = 2650.

Generally, the market index is assigned a base value at the beginning. Let's assume this value to be 1000 here. Let's see how the index value changes with the change in the market value of the index.

Market value Index value

Day 1 2650 1000

Day 2 2500 943.39 (= 1000 x 2500/2650)

Day 3 2700 1018.86 (= 1000 x 2700/2650)

Day 4 2800 1056.60 (= 1000 x 2800/2650)

Day 5 2829 1067.54 (= 1000 x 2829/2650)

Market value Index value

Day 1 2650 1000

Day 2 2500 943.39

(= 1000 x 2500/2650)

Day 3 2700 1018.86

(= 1000 x 2700/2650)

Day 4 2800 1056.60

(= 1000 x 2800/2650)

Day 5 2829 1067.54

(= 1000 x 2829/2650)

Hence, the index value provides a benchmark for comparison. Comparing a company's stock price with this benchmark can help you figure out its performance with respect to the market.

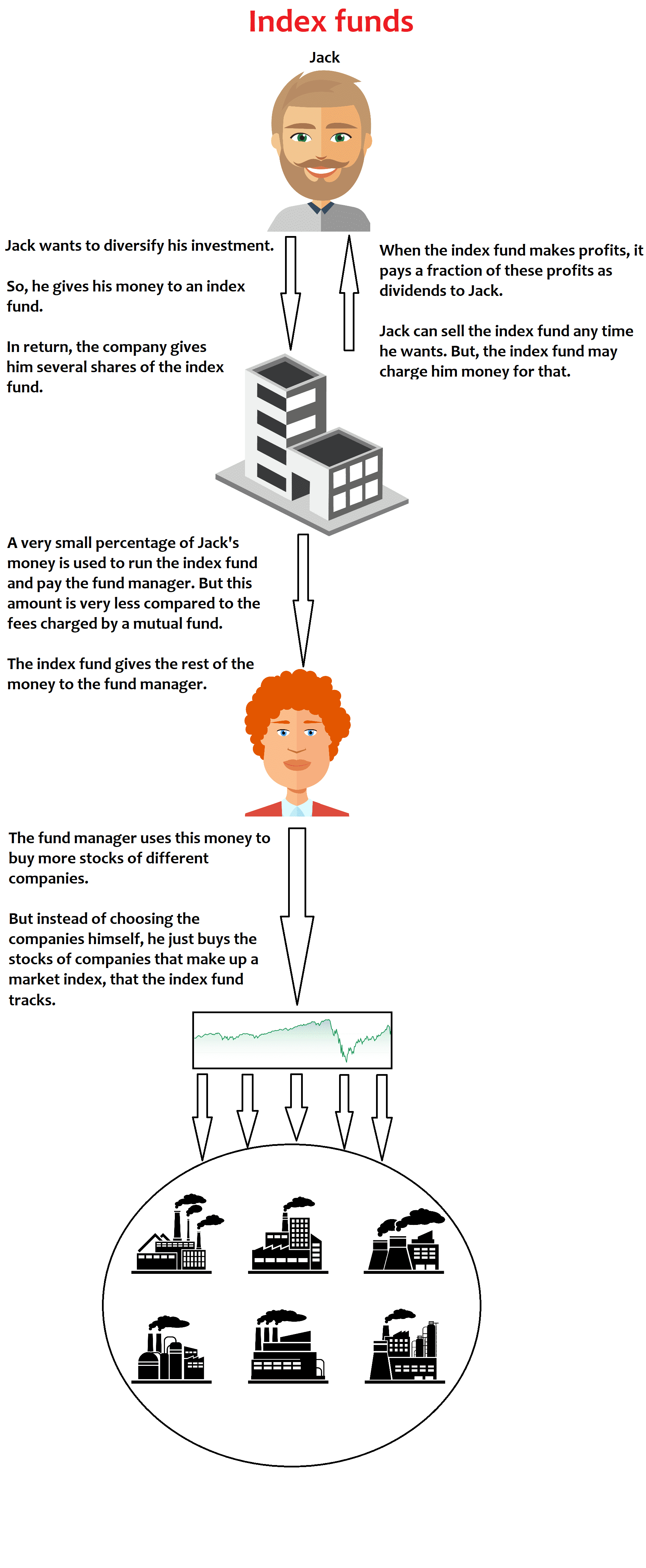

What is an index fund?

An index fund is a type of mutual fund. It is a collection of assets (e.g., stocks) created to resemble a particular market index. It was invented in the 1970s to be an alternative to the notorious mutual funds that charge high fees.

For example, there are index funds in the USA that resemble the composition of the S&P 500. They have stocks in all the same 500 companies that constitute the S&P 500. They may even use the same weights.

Index funds are based on the belief that the market outperforms an individual in the long run. To understand what it means, let's compare it with a mutual fund.

Mutual fund vs. index fund

Complexity of managing

In a mutual fund, a fund manager actively selects the stocks to buy and sell so that maximum returns can be assured. However, as the mutual fund grows, the fund manager has to keep finding new profitable stocks. Therefore, as the mutual fund grows, the difficulty in managing it grows with it. Hence, the returns from a mutual fund could shrink with time.

However, by creating an index fund using the same stocks used in a market index, the hassle of active management of stocks can be evaded.

Hence, the returns of an index fund don't shrink with time. So, in the long run, an index fund can become more profitable than a mutual fund.

Costs

Mutual funds need an active fund manager who has to be paid every month. His salary is taken from the investments of the investors. So, mutual funds are costlier.

On the other hand, index funds are passively managed. There is no active fund manager who needs to be paid every month. Moreover, there is no rapid active purchasing and selling of stocks. Consequently, they don't pay high trading fees.

Hence, index funds are cheaper than mutual funds. This lower expense in index funds translates into higher returns over the long term.

The randomness of a stock's price

In a mutual fund, a fund manager tries to select undervalued assets (stocks, bonds, etc.) to sell at a higher price later. However, every other fund manager and investor is trying to do the same thing. So, he has to compete against other investors and fund managers to successfully outperform the market and make profits.

In sectors where the information about companies is publicly available, fund managers compete against each other using the same information. Therefore, fund managers can't outperform the market in the long run.

For example, let's assume that, on a particular day, the S&P 500 index opens at $1000 and closes at $1002. An index fund that tracks this index could make a profit of $2 at the end of the day. For a mutual fund to outperform this index fund, it should make a profit more than $2 during the same duration.

For this to happen, the mutual fund's fund manager should be able to find a combination of stocks that performs better than the market index. He has to keep doing this again and again, for a mutual fund to remain profitable for a long time. Please note that the above scenario ignores the additional costs that come with maintaining a mutual fund.

Wrong decisions

A fund manager selects a stock based on its expected future profits, calculated using its past values. But, there is no assurance that a stock's future values will follow the same trend as its past values. Therefore, eventually, a fund manager might make wrong decisions and lose money.

Since an index fund is passively managed and depends on the market, the risk of losing money is lesser.

Therefore, compared to a mutual fund actively managed by a fund manager, a low-cost index fund that mimics a particular market index can become profitable in the long run.

What should you know before selecting an index fund?

Index funds are profitable only in the long run. For short-terms less than years, actively managed mutual funds can give you higher returns.

An index fund's goal is not to beat the market and get profits better than everyone else. It is to match the returns of the market, believing that the market always wins. By investing in an index fund, you probably won't make remarkable profits in the short term. However, you will get results consistent with market growth in the long run.

If your goal is to invest in large-scale companies with consistent growth, an index fund is the right choice. However, if your goal is to invest in small-scale companies that are still undervalued to make short-term profits, mutual funds are better.

Index funds are not risk-free. If the entire market is in a state of decline, returns offered by index funds will decline as well. On the other hand, in a mutual fund, an excellent fund manager can sense market decline and reinvest your money to avoid losses.

Index funds are traded like mutual funds. They can be traded after the markets close at the end of the day. If you want to buy or sell a mutual fund, you only get the price it has at the end of the day. If stock prices rise during the day and fall at the end of the day, you cannot benefit from this rise.

Similar to a mutual fund, the dividends from an index fund can be automatically reinvested.

Index funds can be bought from a mutual fund company or a brokerage firm.

Scores

Savings

ROI

Ease of Accessibility

Risk

Low

High ( > Mutual funds)

High

Low (< Mutual funds)

Savings - Low

ROI - High ( > Mutual funds)

Ease of Accessibility - High

Risk - Low (< Mutual funds)

5. Exchange-Traded funds (ETF)

ETFs were invented in the 1990s to serve as a cheaper alternative to mutual funds. They are similar to index funds in the fact that they track an underlying index. However, the difference is that ETFs can be traded like stocks. They can be bought and sold like stocks at any point in the day. As an ETF is bought and sold, its share price rises and falls in response.

ETF offers several advantages over a normal mutual fund. To understand these advantages, we have to understand how an ETF works.

How does an ETF work?

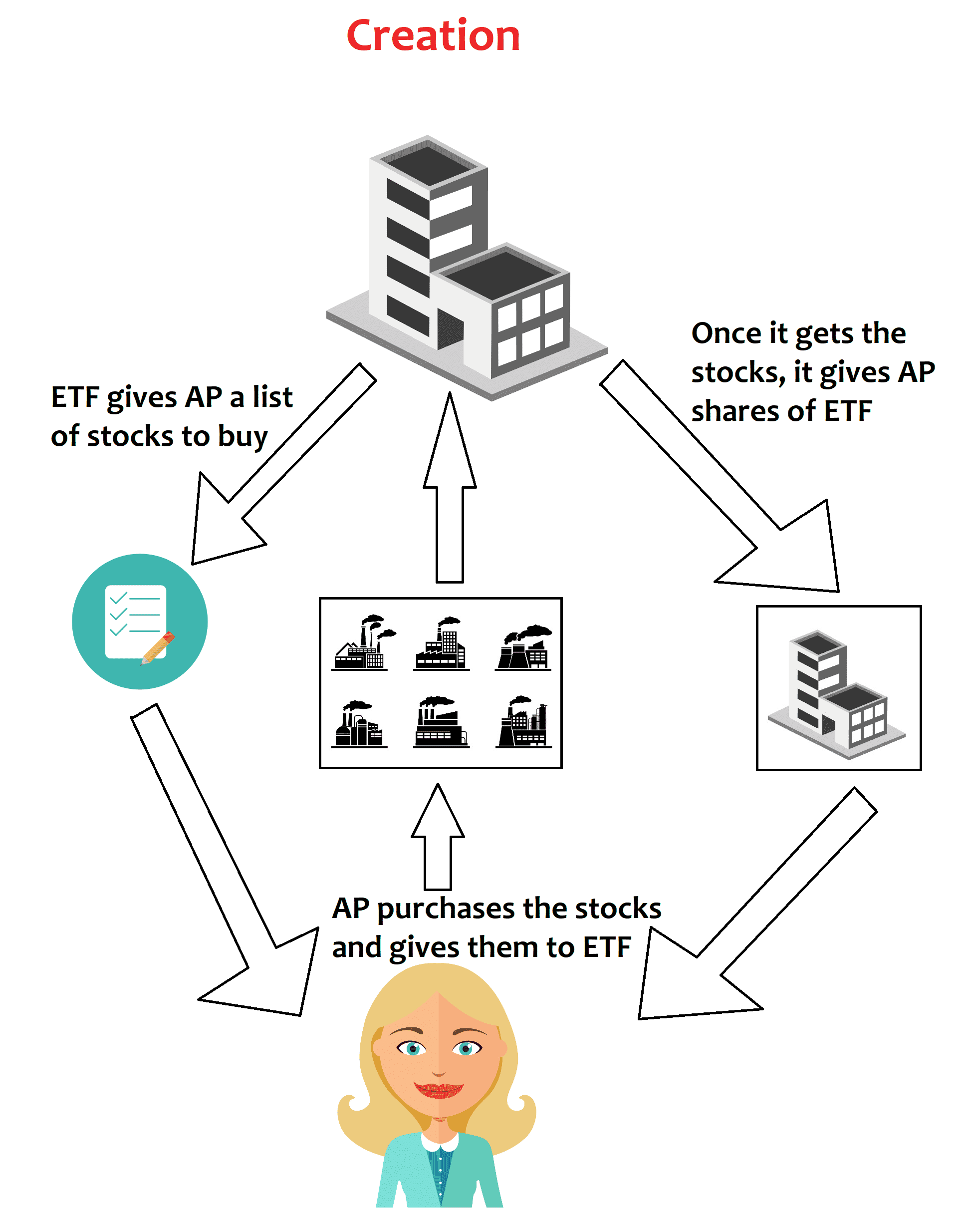

Whenever an ETF wants to create new shares of its own fund, it seeks the help of an Authorized Participant.

The ETF gives the AP (Authorized Participant) the list of assets (e.g., stocks) that constitutes an ETF. AP is generally a person or institution with a lot of buying power.

Creation and Redemption

The AP purchases these stocks from the open market and delivers them to the ETF. In turn, the ETF gives the equivalent number of ETF shares to the AP. Each share of the ETF is priced at its Net Asset Value (NAV). This is called Creation.

Conversely, if the AP wants to get rid of the ETF shares, it can give back the ETF shares and get back the underlying stocks from the ETF. It can then sell these underlying stocks to get back the money it invested for the ETF.

How does the AP benefit from this?

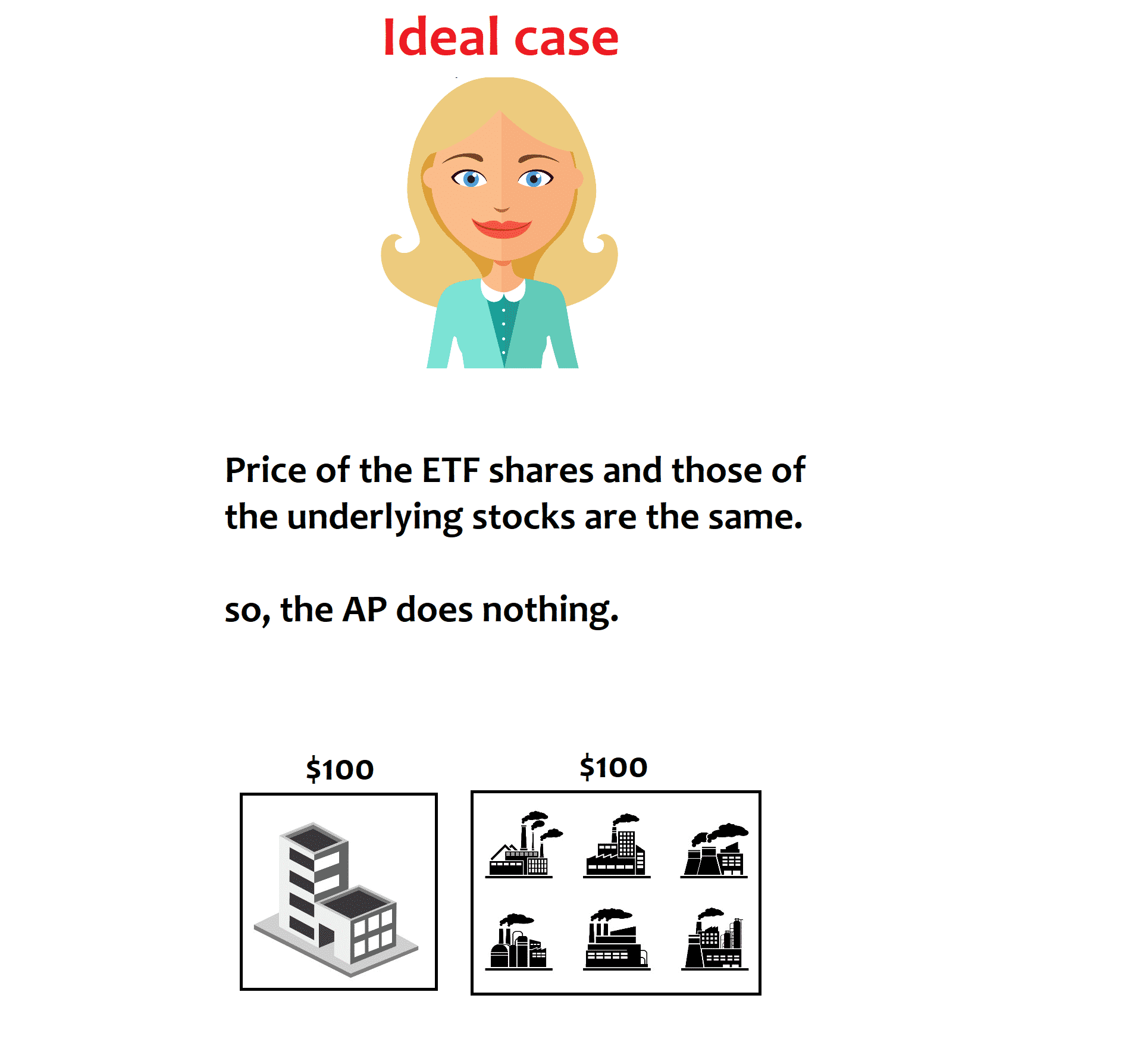

Like mutual funds and index funds, the trading price of an ETF can be different from its NAV. So, the AP is always watching the ETF in the market for price deviations.

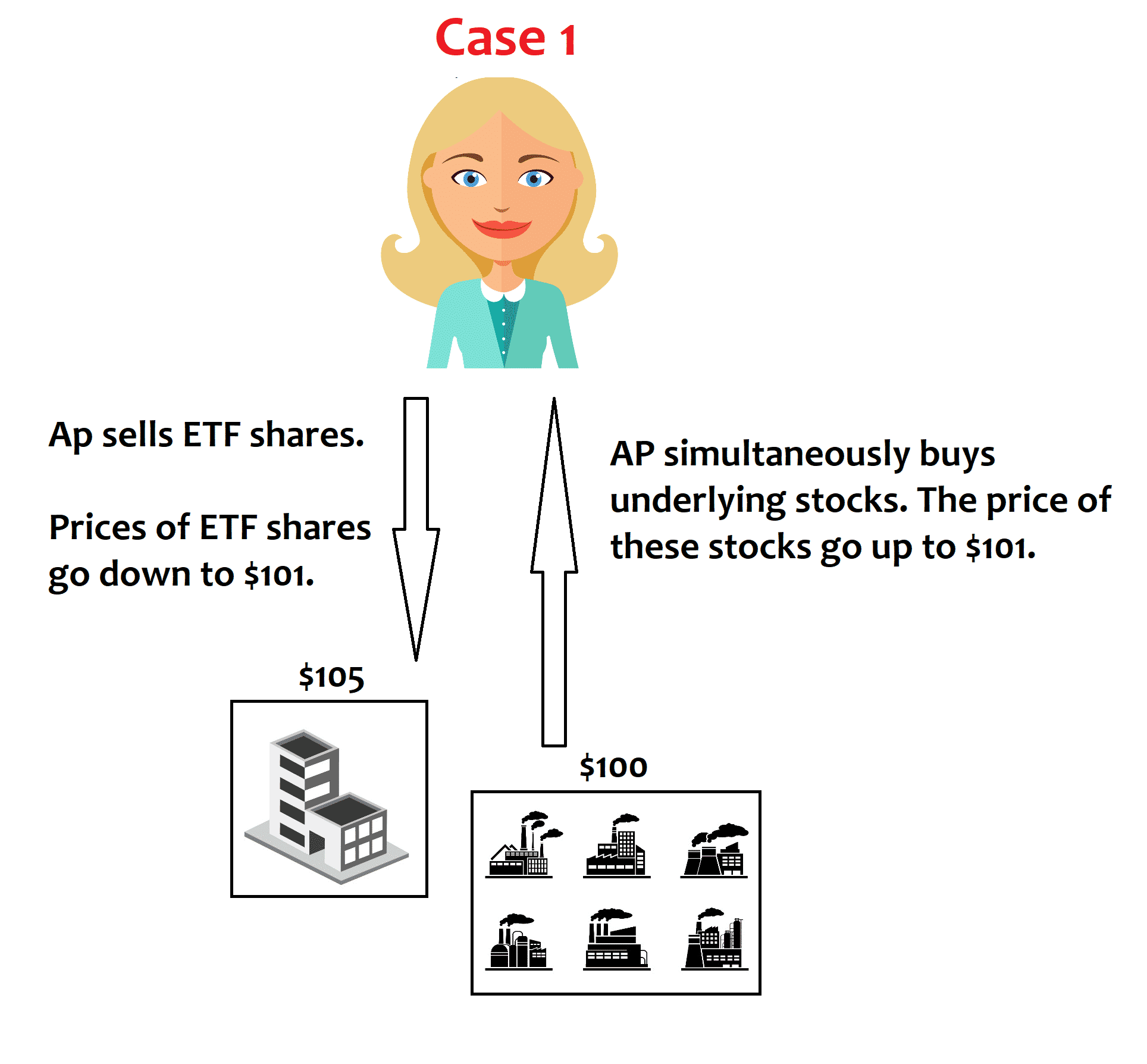

Case 1:

Let's assume that the NAV of an ETF is $100. But due to its demand, its price goes up to $105, while the NAV is still $100. This means that the EFT price has increased without a rise in the costs of the underlying stocks. Now, the AP starts selling ETF stocks at $105.

So, the supply of the ETF stocks increases, and its price reduces. At the same time, the AP goes and purchases the underlying stocks that make up the ETF at $100. So, the prices of the underlying stocks go up. The NAV of the ETF increases as a result. The AP does this until the trading price of the ETF and its NAV equalize (say $101).

During this process, the AP sells the ETF at $105 and purchases the underlying stocks at $100. So, it has made a profit of $5. At the same time, the NAV of the ETF increases to $101, attracting more investments. Therefore, both the AP and the ETF benefit from this mechanism.

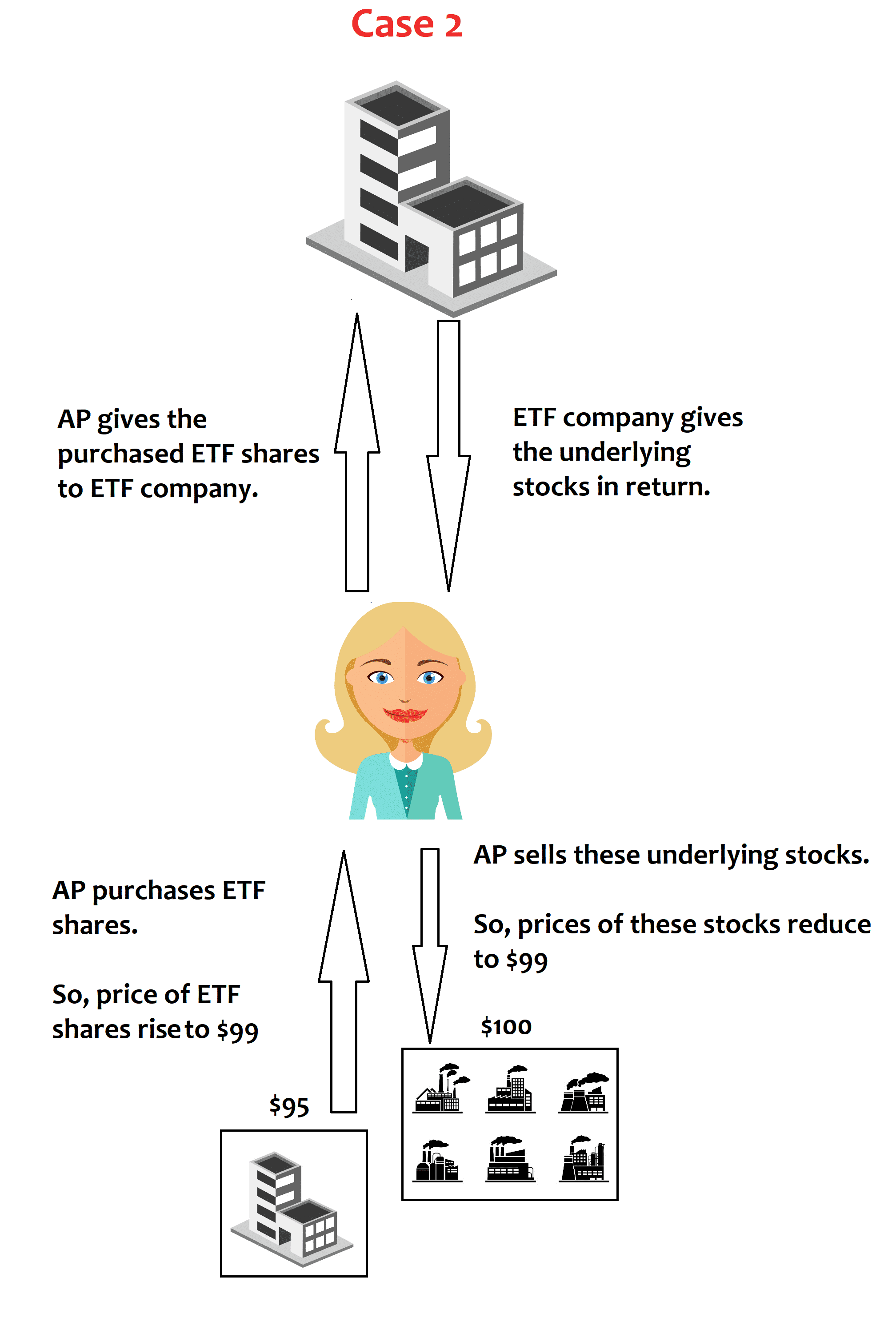

Case 2:

Now let's consider the opposite case. Let's assume that the ETF's price has gone down to $95, even though its NAV is $100. The AP purchases several shares of the ETF at the reduced price of $95. This increases the demand for the ETF, thereby pushing its price up. Then, the AP approaches the ETF and exchanges some of the ETF shares for the underlying stocks.

Finally, it sells these underlying stocks in the market, thus increasing their supply. Therefore, the prices of the underlying stocks go down. This process continues until the price of the ETF and its NAV equalize (let's say $99).

The AP purchased the ETFs at a discounted rate of $95 and redeemed them at the NAV of $100. So, the AP has made a profit of $5. At the same time, the AP has increased the ETF's price from $95 to $99 to equalize it to the NAV. So, it is profitable to the ETF as well.

ETFs vs. mutual and index funds

Costs

In a mutual fund, a lot of purchasing and selling happens, incurring a lot of transaction fees. In an ETF, all the purchasing and selling are done by the AP. So, there aren't any transaction costs incurred by the ETF.

If an investor wants to sell his shares, the mutual fund has to sell its underlying stocks. This incurs transaction costs, which affect the returns of the mutual fund. On the other hand, an ETF can sell its shares to another investor to raise the money. So, there aren't any transaction costs in this case as well.

Transparency

A mutual fund is not obliged to disclose the identity of its underlying stocks. The stocks underlying an ETF is information that it provides to its APs. This information is freely available. So, before investing in an ETF, you can find out where your money will go.

Tax

Whenever a mutual fund sells underlying stocks, it has to pass on these gains (in some countries) to its investors. If these gains are big enough, you have to pay taxes. In an ETF, when the AP redeems the ETF shares for underlying stocks (case 2 above), the ETF can choose which shares to surrender to the AP.

Most of the time, it gives away the stocks that are highly profitable at the moment. So, if, at a point in time, the ETF sells its underlying stocks, there may not be any gains. So, it doesn't have to pass on any money to its investors. So, you may not pay any tax until you sell the ETF.

Fair play

If the price of a mutual or index fund increases or decreases with respect to its NAV, there is nobody to regulate it. However, in an ETF, the APs regulate the market, ensuring that the EFT's price always equals its NAV. So, you can always be sure that you are paying the fair price for an EFT.

Trading

Mutual and index funds can be traded only after the market closes at the end of the day. ETFs, however, are traded like stocks. They can be bought or sold throughout the day. So, you can sell an ETF when its price is high during the day and make profits.

What should you know about ETFs before buying one?

Tax benefits

Not all ETFs offer the underlying tax benefits. If an ETF consists of bonds, it might pay you dividends every month, which is taxable.

Index

Not all ETFs track an index.

Types of ETFs

There are different types of ETFs, including Currency ETFs, Bond ETFs, Commodity ETFs, and Industry ETFs. The tax benefits may vary from one type of ETF to another.

Diversification

Not every ETF offers diversification and reduces risks. Industry ETFs, for example, track a particular industry or sector. They offer less diversification and are prone to risks, because an entire industry may suffer losses. An example of this scenario would be the airline ETFs during the Corona outbreak.

Trading fees

ETFs can be traded throughout the day when the market is open. This creates the urge to sell or buy ETFs, thus incurring transaction costs. If you do this often, the costs may add up to affect your returns.

Returns

As with an index fund, don't aim to beat the market with an ETF. Most ETFs track an index. So, they may not offer high returns.

Scores

Savings

ROI

Ease of Accessibility

Risk

Low

High (<= Index funds)

High (> Index funds)

Low (< Index funds)

Savings - Low

ROI - High (<= Index funds)

Ease of Accessibility - High (> Index funds)

Risk - Low (< Index funds)

6. Peer-to-Peer Lending

As the name suggests, Peer-to-Peer Lending makes it possible for individuals to avail loans from other individuals directly. It eliminates the need for a middleman, normally a financial institution. It has only been in existence since 2005.

Borrowers

For borrowers, it offers lower interest rates and flexible terms when compared to banks. Peer-to-Peer lending companies don't need collateral for issuing a loan. Instead, they assign a credit grade to the borrower.

The credit grade depends on the borrower's credit score, income, loan amount, and term. The interest rate for the loan depends on the credit grade. The entire process, from applying for the loan and getting a loan, could finish within a few hours.

Lenders

As a lender, you can open an account with a Peer-to-Peer lending company and deposit an amount. You can choose whom to lend your money to, depending on his/her credit score, income-to-debt ratio, loan type, loan amount, loan term, etc. You don't even have to loan the entire amount a borrower needs.

Instead, you can break your whole investment into small chunks called notes. You can then invest your notes in multiple loans. For example, if you have $1000 to invest, you can break it into 20 notes ($50 each) and loan it to 20 people. This offers the advantages of a mutual fund at a lower price.

You can diversify your investment by distributing your notes between high-risk, high-interest-rate loans, and secure loans. Thus, you can get higher returns while ensuring that you don't lose all your money if some loans default. Indeed, some people who invested in Peer-to-Peer lending have reported double-digit returns every year.

What to know before you invest in Peer-to-Peer lending?

Risk

No investment is without risk. Peer-to-Peer lending is also risky. The average rate of default is higher in Peer-to-Peer lending than some other investments. Hence, if you invest all your money in a high-risk loan, hoping for high returns, you may lose everything. However, if you have diversified your investment, the probability of all the loans defaulting is very low.

Not tested -

Peer-to-Peer lending has been gaining traction for only a decade. Hence, it is not tested for recession. If the borrowers will repay the loan in a recession is a big question. This brings us to the next issue.

Not insured

Any investments you make in a Peer-to-Peer lending is not insured. So, making wise decisions on when to invest in Peer-to-Peer lending and which loans to pick lies entirely upon your shoulders.

Reinvest

In a government bond and a Certificate of Deposit, you invest a huge amount at the beginning. In return, you get regular interest payments until the expiry of the maturity period. Once the maturity period expires, you get your original investment back. But Peer-to-Peer lending works on the concept of loaning money.

At the end of the loan period, you won't get your original investment back. Instead, you receive a part of your investment plus the interest every month. So, it is entirely upon you to reinvest this amount. If you keep spending the amount you receive every month, you won't have any investment left when the loan period expires.

Costs

Before investing in a Peer-to-Peer lending company, find out who pays the commissions - You or the Borrower? If you have to pay the commissions, what percentage of your investment should you pay? Are there any hidden costs?

Taxes

How will you be taxed on your returns? Depending on your country, it may vary.

Transfer

Can you set up a retirement account and transfer your returns to it?

The credibility of the company

Before investing in a Peer-to-Peer lending company, find out how long it has been in existence. What do its customers say about it? Research properly because your investment is not insured.

Liquidity

Unlike bonds, notes are not traded in an exchange. So, early withdrawal is only possible if another investor takes over your loan. However, if interest rates rise during this period, nobody would be willing to take over your loan, which has a lower interest rate.

No fund manager

In a mutual fund, a fund manager takes care of all your investments. Even though it makes a mutual fund costly, at least you don't have to worry about making the right choices. In Peer-to-Peer lending, however, you have to build your own portfolio. So, depending on the loans you choose, it can either be a boon or bane to you.

Scores

Savings

ROI

Ease of Accessibility

Risk

High

High

Low

Medium to High

Savings - High

ROI - High

Ease of Accessibility - Low

Risk - Medium to High